In the world of business, a sale and lease back is one financial option used often. The article breaks down what exactly a sale and lease back is, explains how it differs from a sale, and provides examples of different types of equipment that are available for purchase.

What Is A Sale And Lease Back?

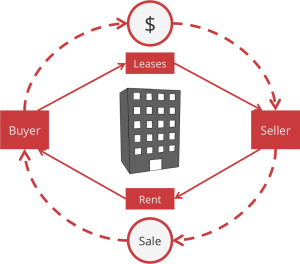

A sale and lease back is a real estate transaction in which a property is sold, but the buyer leases the property back from the seller. This type of transaction is often used to finance a purchase or to reduce the amount of money that needs to be borrowed for a purchase.

How Does It Work?

The sale and leaseback process is a common way to finance real estate. The buyer purchases the property and then leases it back to the original owner, who continues to live in the home while collecting rent from the tenant. The lease typically has a fixed term (often 10 years) and can be terminated early by either party with no penalty.

The benefits of sale and leaseback include:

- Flexibility – The sale and leaseback process allows you to adjust your timing as needed, without having to commit to a long-term contract. This flexibility can be particularly beneficial if you’re waiting for the right property or you don’t have enough money up front.

- Risk reduction – By purchasing the property and leasing it back, you take on only minimal risk. If you decide not to pursue the purchase or if things go wrong, you won’t have lost too much money overall.

- Tax advantages – When you purchase the property through sale and leaseback, you may qualify for favorable tax treatment. This includes depreciation deductions (which reduce your taxable income), exemptions from capital gains taxes, and even relief from self-employment taxes (if you are using part of your house as your primary residence).

- Liquidity – Selling the property outright can be difficult if you don’t have enough money saved up, but leasing it back gives you greater flexibility in terms of when and how you sell.

- Minimal paperwork – The sale and leaseback process is typically completed in a matter of months, without the need for extensive paperwork.

Business Equipment Financing

Sale and lease back are two of the most common options for business equipment financing. With this type of financing, you sell the equipment, but keep the rights to use it until the lease agreement expires. Once the lease expires, you can either re-lease the equipment or buy it outright. This type of financing is popular because it allows businesses to use valuable assets while they remain financially secure.

Installment financing is another common option for business equipment. With this type of financing, a lender loans money over a set period of time, usually ranging from six months to five years. The borrower pays back the loan with interest over time. This type of financing is popular because it gives businesses more control over their finances and allows them to borrow money without selling equity in their company.

Loan options are also available for businesses looking to purchase or finance business equipment. These loans can be arranged through banks or credit unions and have varying terms and interest rates.

Types of Sale and Lease Backs

There are two main types of sale and lease back arrangements: outright sale and leased purchase. Outright sale means that the property is sold without any associated liabilities, such as rent payments or mortgage repayments. Leased purchase means that the property is bought with the intention of leasing it back to the original owner or their successor in title.

Here’s a breakdown of the two main types of sale and lease back:

Outright Sale

With an outright sale, you own the property outright and don’t have any associated liabilities. The downside is that this type of sale can take longer to complete than a lease purchase, because you need to go through the whole estate process – including obtaining land registry approvals – before anything can happen. The upside is that there’s no potential for rent hikes or missed payments, since there’s no landlord involved.

Lease Purchase

With a lease purchase, you buy the property with the intention of leasing it back to the original owner or their successor in title. This type of arrangement has several advantages over an outright sale: firstly, it can speed up the process of buying or renting property, since you don’t have to go through the whole estate process. Secondly, there’s flexibility in terms of how long you have to live in the property – you can stay for as long as you want, or you can rent it out and pocket the proceeds. Finally, there’s no potential for rent hikes or missed payments, since there’s no landlord involved.

What Is An Operating Lease?

An operation lease is a type of leasing agreement in which the lessee (the business using the leased property) rents the property from the owner (usually for a period of time, such as a year). The lessee pays for the use of the property, and typically has all or part of the rent paid by a monthly or annual rental fee. The owner keeps any earnings generated from renting out the property.

The main benefits of an operation lease are that it can be used to quickly and easily acquire a desired property without having to go through the long and complicated process of purchasing it outright. Additionally, an operation lease can be advantageous if you want to use a particular property for only short periods of time, as you will not have to worry about maintaining or upgrading it.

What is Aviation Finance?

Aviation finance is the process of securing financing for aircraft purchases and leases. The most common form of aviation finance is a loan, but other forms include lease agreements and sale-and-leaseback arrangements.

Loan options typically involve a lender providing a lump sum of cash to be used as payment for the aircraft purchase or lease. Loan terms can last from one month to 10 years, with a number of optional early payoffs available. Aircraft loans are often structured with interest rates above the market rate, in order to compensate lenders for taking on risk.

Lease agreements are another popular form of aviation finance. A lessee pays an upfront fee, then rents the aircraft from the lessor for an agreed period of time. At the end of the lease term, the lessee has the option to buy the aircraft from the lessor at a predetermined price.

Medical Equipment Leasing

When it comes to medical equipment leasing, there are a few things to keep in mind. First, make sure you understand the different types of leases available. There are options like pay as you go, monthly or yearly leases, and short-term leases. Second, be sure to compare rates and terms between companies. Third, be aware of any special features that may be included in the lease agreement, such as rent credits or allowances for early termination. Fourth, make sure you understand your rights and responsibilities when leasing medical equipment. Finally, always read the fine print in the lease agreement before signing anything.

Conclusion

When it comes to real estate, it can be hard to know where to start. Thankfully, we’ve put together this guide on sale and lease back so that you can get started with the basics of the market and find your perfect home. Whether you’re looking for a short-term fix or something